Impact of An Ageing Population on the Sustainability of the Health Systems and Path to Achieving Universal Health Care Coverage: The Case of Mauritius, A Small Island Developing State

by Ajoy Nundoochan*, Akshay H. Nundoochan

WHO Country Office, Mauritius

*Corresponding author: Ajoy Nundoochan, WHO Country Office, Mauritius

Received Date: 10 August, 2025

Accepted Date: 19 August, 2025

Published Date: 23 August, 2025

Citation: Nundoochan A and Nundoochan AH (2025) Impact of An Ageing Population on the Sustainability of the Health Systems and Path to Achieving Universal Health Care Coverage: The Case of Mauritius, A Small Island Developing State. Int J Nurs Health Care Res 8:1661. DOI: https://doi.org/10.29011/2688-9501.101661

Abstract

Background: Public health advancements have extended life expectancy in Mauritius, but changing demographics threaten the financial sustainability of the health sector. As Mauritius is committed to achieve Universal Health Coverage, this study examines the impact of an ageing population on Mauritius’s health sector and explores policy options to mitigate the financial gap. Methods: Data sources included the UN Department of Economic and Social Affairs Population Division, OECD revenue statistics, and WHO Global Health Expenditure Data base. The Population Ageing Financial Sustainability gap for Health systems Simulator 2.0 was used to estimate the financial burden of an ageing population, identify fiscal and policy measures to reduce the gap. Results: With a scenario where health spending for an 85-year-old is 3.5 times higher than for a 55-year-old and 4.7 times higher than for a 25-yearold, an additional USD 67 per person will be needed to meet the health needs of the ageing population, representing 0.7% of GDP, by 2060. In 2022, General government health expenditure accounted for 3% of GDP. Policy changes, such as increasing taxes on goods and services by 100 base points, could reduce the financial gap by USD 18 per person. Adjusting the mix of taxes that are used to pay for health can further reduce health financing gap by USD 11 per person. Conclusion: Revisiting health financing strategies is crucial to ensure sustainable financial resources, efficiency, equity, and protection against catastrophic health expenditures. Adopting the WHO Integrated Care for Older People approach will help integrate elderly health needs into primary care, enhance both intrinsic capacity and functional ability, and optimize health spending on geriatric care.

Keywords: Ageing population; Universal health coverage; Financial sustainability

Introduction

Background

The recent past decades have been marked with a steady rise in healthcare expenditure across many countries, both on a per capita basis and as a share of GDP. This led to a growing sentiment that the upward trend unlikely to be abated would constitute a major risk to the financial sustainability of the health systems ahead. Concurrently, more and more countries are confronted with the consequences of an ageing population [1,2]. There is no room for complacency with respect to the shift in demographics as there is a well-established link between ageing and higher healthcare expenditure, and furthermore an ageing population is growingly viewed as a central factor behind rising healthcare costs, both now and in the future [3,4].

The growing discussion around population ageing focuses on its potentially harmful effects on the long-term financial sustainability of health systems. Fiscal sustainability refers to a government’s ability to support public health spending at manageable levels over time. While rising health expenditures would not be an issue in a world without resource limits, but when such spending grows faster than the economy, it can lead to serious sustainability challenges [5,6]. Sustaining health sector financing is essential for robust health systems and is crucial for advancing toward universal health coverage (UHC). In 2015, as part of the 2030 Agenda for Sustainable Development, countries committed to achieving UHC. UHC ensures that people and communities receive the necessary health services of adequate quality without facing financial hardship (WHO 2010) [7]. Ensuring no one is left behind in the Sustainable Development Goal agenda involves addressing inequalities across all population groups, including the elderly, not just the poorest.

An ageing population poses major challenges to the fiscal sustainability of health systems. As people age, the demand for health care services increases, notably for chronic diseases management, impacting on health spending, primarily funded by public resources, on the basis of the positive association between health care utilisation and increasing calendar age [8,9]. Population ageing not only increases healthcare expenditures but also affects the capacity to generate sustainable funding for health systems. As the working-age population shrinks, as a result of ageing population, governments face reduced revenues from income, consumption, and property taxes, as well as lower social contributions tied to employment. Concurrently, slower economic growth and a declining labour participation, exert additional strain on public finances, diverting resources away from healthcare.

Growing pension and social security obligations also divert public funds away from healthcare, intensifying fiscal pressures. These demographic shifts underscore the urgency for policymakers to develop strategies that balance the growing demands of an ageing population with the imperative to maintain sustainable and equitable health systems for future generations. Evidence abounds that population ageing will significantly increase health spending, primarily funded by public resources, on the basis that of positive association between health care utilization and increasing calendar age [10-12]

The European Commission forecasts that demographic changes will raise public health expenditure in EU Member States by 1.1 percentage points of GDP, from 6.8% to 7.9%, between 2016 and 2060 [13]. However, there is debate about the role of age in determining health expenditure, with factors like time-to-death, morbidity, technological advancements, national income growth, and healthcare organization also influencing costs and service volume [14,15]. As the demographic composition evolves, the revenue generated through these channels may vary. The case of Japan demonstrates that while income tax revenues tend to decline with ageing populations, consumption taxes generally remain stable [16]. Analysts predict that investing in healthy ageing programmes will counter the adverse impacts of population ageing on both the economy and health spending [17] as older people remain active and productive for longer and reducing the demand for healthcare [18].

Mauritius, a small island developing state, serves as an intriguing case study due to its demographic and epidemiological shifts, economic transformation, and the challenges posed by an ageing population in achieving universal health coverage (UHC). In the 1960s, Mauritius faced high fertility and mortality rates, with a population growth rate of around 3% annually. Implementation of effective population control programs, led to a significant drop in the fertility rate from 6 children per woman in 1960 to 1.4 children per woman in 2020, and a corresponding decline in population growth from 3% annually in 1960 to 0.3% annually in 2020. Currently, Mauritius has one of the lowest population growth rates in the developing world. The proportion of older adults is increasing due to rising life expectancy, with male life expectancy at birth improving from 59 years in 1962 to 70.3 years in 2020, and female life expectancy from 62 years in 1962 to 77.2 years in 2020 and declining fertility rates [19]. This has brought in its wake the problem of ageing.

Over the past two decades, Mauritius has maintained a steady annual economic growth rate of at least 3.5%, achieving a per capita GDP of USD 11,871 in 2024. The country’s health improvements, characterized by increased life expectancy and low communicable disease rates, are largely attributed to its commitment to providing free healthcare services in all government-owned facilities. The epidemiological landscape is predominantly shaped by noncommunicable diseases (NCDs), which account for 84% of the disease burden. In 2022, the life expectancy at birth on average was 76.4 years [78.9 years for Females; 73.9 for Males]. General government health expenditure (GGHE) represents 2.85% of GDP. Despite the availability of free public healthcare, private health expenditure constitutes 53.8% of total health spending. Out-ofpocket (OOP) expenses and voluntary insurance reimbursements account for 83% and 13% of private health expenditures, respectively. Since 2017, GGHE has surpassed household OOP expenditure [20- 22].

Between 2000 and 2022, national population censuses revealed a shift from extended to nuclear family structures, with a notable rise in older adults living independently-21.4% in 2022 compared to 15.2% in 2000 [23]. Consequently, as this trend accelerates and availability of family members to provide support and care for older people decline, reliance on formal health and long-term care will heighten and leading to higher demand and expenditure on geriatric care.

The Paper has Three Objectives

- Analyse how an ageing population will affect GDP by 2060, considering six scenarios of increased health expenditure.

- Calculate the financial shortfall if current health-financing strategies remain unchanged, but indirect taxes (especially VAT) increase by 100 basis points.

- Use qualitative findings to identify and evaluate potential policy measures to mitigate the economic effects of an ageing population.

The study is motivated by several considerations. The costs for treating chronic diseases associated with old age, along with the need for both formal and informal care, pose dire economic challenges leading to higher out of pocket expenditure, reducing financial protection and ultimately reversing gains achieved in terms of attaining UHC. Small Island Developing States (SIDS), including Mauritius, are particularly vulnerable to the effects of population ageing. These countries often experience high rates of youth outmigration, which accelerates demographic ageing and reduces the working-age population. According to UN DESA, SIDS are growing more slowly than the global average, with their population expected to increase from 73.5 million in 2023 to 85.4 million by 2050 [ 24]. Mauritius faces additional challenges due to climate change, which disproportionately affects the elderly. These overlapping vulnerabilities-ageing, economic strain, and climate impacts-underscore the urgency of policy responses to safeguard health system sustainability and protect the well-being of older populations [25,26,].

Method

Sources of Data

The primary sources of data include the United Nations Department of Economic and Social Affairs Population Division, OECD revenue statistics, and the WHO Global Health Expenditure Data

base. Population projections for Mauritius are based on national censuses and vital registration data. These projections, made by the United Nations Population Division, are categorised into five-year age groups ranging from 0-4 years to 85 years and older. The projections extend to the year 2100 and consider potential outcomes at global, regional, and national levels [27].

Modelling and Data Analysis

In 2022, the European Observatory on Health Systems and Policies, along with the WHO Kobe Centre, introduced the Population Ageing Financial Sustainability Gap for Health Systems (PASH) Simulator tool. This tool forecasts future health expenditures and revenues up to the year 2100, based on changes in the age structure of populations at the country level. It guides countries in planning and evaluating healthcare needs as demographic shifts occur, and in exploring sustainable financing options for their health systems [28,29].

The PASH Simulator tool version 2.0 calculates the expected financing gap between health revenues and expenditures using two hypothetical health expenditure profiles based on age. The first profile compares the health spending of an average 85-year-old to that of a 55-year-old, while the second compares the spending of an average 85-year-old to that of a 25-year-old. Six health expenditure profiles are analysed, with ratios ranging from 1.3 to 3.7 (for 85-year-olds relative to 55-year-olds) and from 1.5

to 8.4 (for 85-year-olds relative to 25-year-olds). The profiles are labelled as Scenario 1 to Scenario 6 [28].

Findings

Descriptive Statistics

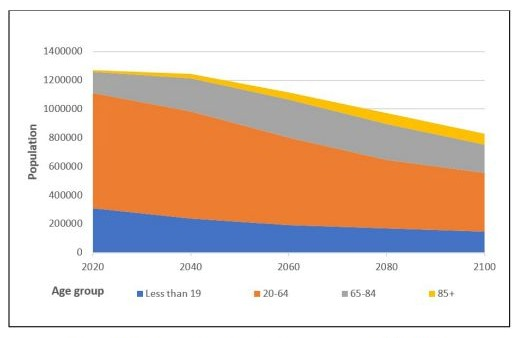

Figure 1: Projected population by age group, 2020-2100.

Source: European Observatory on Health Systems and Policies. Population Ageing financial Sustainability gap for Health systems

(PASH) Simulator, 2022

In 2020, individuals aged 65 and older made up 13% of the total population. The PASH simulator projects this proportion to increase to 22% by 2040 and 29% by 2060. Meanwhile, the working-age population (20 to 64 years old) is expected to drop from 63% in 2020 to 60% in 2040 and 54% in 2060. Consequently, the dependency ratio is anticipated to rise from 0.58 in 2020 to 0.67 in 2040 and 0.83 in 2060. With the fertility rate projected to remain below the natural replacement level, the total population is forecasted to decline to 1.12 million by 2060 and 0.83 million by 2100, representing reductions of 12% and 35%, respectively [28].

|

Hypothetical health expenditure by

age profile a |

Scenario 1 |

Scenario 2 |

Scenario 3 |

Scenario 4 |

Scenario 5 |

Scenario 6 |

|

Average per

person health spending for a 85 year old (relative to a 55 year old) |

1.3 |

2.2 |

2.4 |

2.9 |

3.5 |

3.7 |

|

Average per person health spending for a 85 year

old (relative to a 25 year old) |

1.5 |

3 |

4.9 |

5.8 |

4.7 |

8.4 |

|

0.6 |

15.5 |

32.2 |

34 |

24 |

45.7 |

|

|

Projected financing gap (deficit) for health

spending per person in 2022 USD |

2 |

43 |

90 |

95 |

67 |

127 |

|

% of GDP |

0 |

0.4 |

0.9 |

0.9 |

0.7 |

1.3 |

|

Assumption: No change in Health financing (in %

of public health spending) - Social contributions 6%, Taxes on goods and

services 59%, Taxes on income, profits, and capital gains 30%, and Taxes on property 5% |

||||||

|

Projected financing gap (deficit) between health

revenues and expenditures in base points by 2060 (base year 2024=100) |

5.8 (surplus) |

9.1 |

25.8 |

27.6 |

17.6 |

39.3 |

|

Projected financing gap (deficit) for health

spending per person in 2022 USD |

16

(surplus) |

25 |

72 |

77 |

49 |

110 |

|

% of GDP |

0.2 |

0.2 |

0.7 |

0.8 |

0.5 |

1.1 |

|

Assumption: No change in Health financing, except

for an increase of 100 base points on Taxes on goods and services (1% change

equals a change of 100 basis points). |

||||||

Table 1: Descriptive statistics for selected scenarios of health expenditures by age profile.

Source: European Observatory on Health Systems and Policies. Population Ageing financial Sustainability gap for Health systems (PASH) Simulator 2.0

Cast aside baseline scenario 1 (assuming per capita health spending for a person over 85-year-old is 1.3 times and 1.6 times greater relative to a 55- and 25-year-old, respectively), the remaining five scenarios affirm that the impact of an ageing population in Mauritius will be rising health spending per person (2022 USD) by 2060 compared to 2024, as illustrated in table 1 above. According to the PASH model, taxes on goods and services accounts for a large share of national health expenditure (59%), followed by taxes on incomes and corporate profits (30%). The financing gap, represented by the difference between health revenues and health expenditures, is projected to widen over the period running to 2060 [28].

Given the high costs of treating diseases common in old age, such as heart disease, cancer, and diabetes, which require both medical treatment and care, Scenario 5 seems most relevant for Mauritius. In this scenario, the average health spending for an 85-year-old is 3.5 times higher than for a 55-year-old and 4.7 times higher than for a 25-year-old. This scenario also assumes distinct gender differences throughout the life course. Women in early working ages typically incur higher average per capita health expenditure than men. For instance, a woman of 25 years old health expenditure is about 1.6

times greater than that of a man. However, this pattern shifts in later years. Reaching the 85 years mark, men tend to spend more on healthcare, with expenditures approximately 1.2 times higher than those of women. Based on this, it is estimated that by 2060, an extra USD 67 per person will be required to cover the additional healthcare costs due to an ageing population, representing about 0.7 % of the GDP. It is to be noted that Domestic GGHE accounted for 3% of GDP in 2022. [22,28].

As Mauritius experiences a shift in the family structure, from extended families to nuclear families, and traditional practices of family members caring for the elderly diminish, there will be a greater dependence on formal healthcare and long-term care services. Additionally, as more women join the workforce, the financial impact of an ageing population on health systems and long-term care will significantly increase.

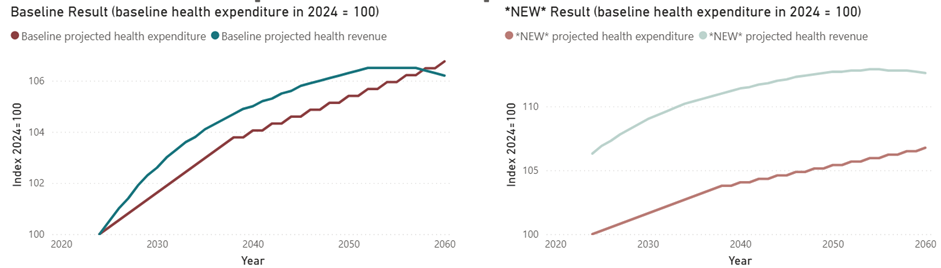

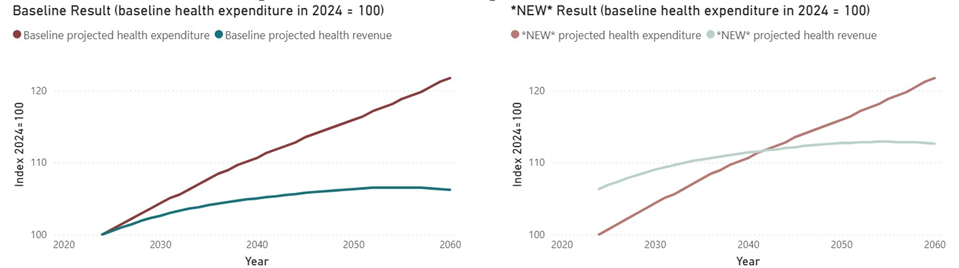

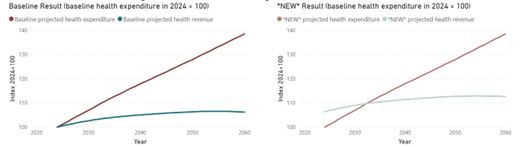

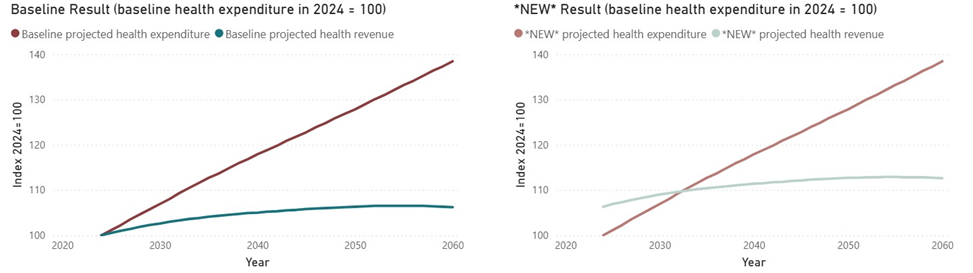

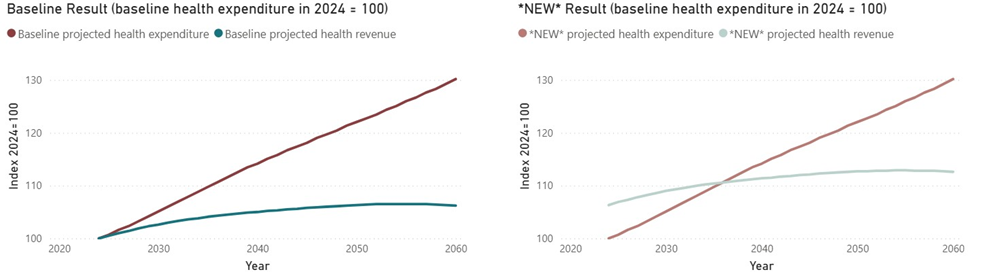

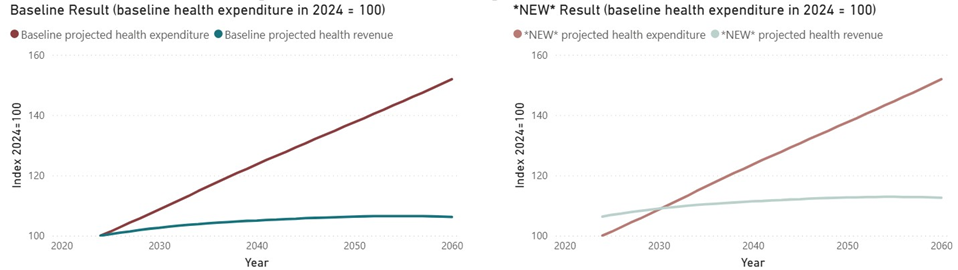

Adjustments in health financing policies can impact revenue sources and help reduce the health financing gap. For instance, increasing taxes on goods and services by 100 basis points is projected to lower the financing gap by USD 18 per person (from USD 67 to USD 49), which translates to a decrease of 6.4 basis points under Scenario 5. Consequently, the financial gap is expected to shrink from 0.7 % to 0.5 % of GDP. Notably, applying a 100-basis point increase in taxes on goods and services across all six scenarios, as shown in Figure 2 by the NEW Results, will delay the emergence of the health financing gap until at least 2032, compared to the Baseline results [28].

Scenario 1

Scenario 2

Scenario 3

Scenario 4

Scenario 5

Scenario 6

Figure 2: Expenditures and revenues (baseline and projected) for health systems, 2020-2060 (index 2024 = 100).

Source: European Observatory on Health Systems and Policies. Population Ageing financial Sustainability gap for Health systems (PASH) Simulator 2.0

Discussions

The PASH model reveals that most of the conceivable scenarios indicate significant and growing financial demands for age-related care over time. This challenge is intensified by the disproportionate impact of ill health conditions among the elderly on the poor and vulnerable populations. Consequently, health sector financing strategies must be re-evaluated to ensure sustainable and adequate financial resources, while promoting efficiency and equity in resource utilisation. Additionally, this approach will help maintain financial risk protection against catastrophic health expenses in the pursuit of UHC. To bridge the financial gaps in the health sector due to an ageing population, adopting a national insurance scheme, as seen in other countries, may be an option. However, prior to implementing such a decision, the counterproductive effects of the gradual decline in the working age population over the next 4060 years as well as the large size of the informal economy need to be weighted carefully. The most recent international evidence available should be pondered to ascertain that introduction of a medical insurance scheme, is in alignment with the objectives and goals of UHC. Furthermore, it is essential that progressive universalism is ensured, whereby the poorest are targeted and covered.

Adjusting the mix of revenue sources to fund higher health expenditures is a workable possibility. In Mauritius, the PASH model assumes that around 59% of health expenditures are funded by taxes on goods and services Although there is no specific policy for sin taxes, taxes on alcohol and tobacco products made up nearly 75% of total public health expenditure in the 2023/24 fiscal year. However, changing the mix of financing sources must be done carefully to avoid a public revenue deficit. If the share of Social Contributions and Property taxes remains the same, but the share of taxes on goods and services is reduced from 59% to50%, and the share of taxes on Income, Capital, and Profit increases from 30% to 39%, the health financing gap would decrease by 4.0 basis points, reducing the gap by USD 11 per capita (0.1% of GDP [28].

General government health expenditure (GGHE) accounts for 2.85% of GDP. Despite the availability of free public healthcare, private health expenditure makes up 53.8% of total health spending. Out-of-pocket (OOP) expenses and voluntary insurance reimbursements account for 83% and 13% of private health expenditures, respectively. Since 2017, GGHE has surpassed household OOP expenditure [22].

Catastrophic health expenditure (CHE) due to out-of-pocket payments (at 10% of household income) in Mauritius increased from 6.5% in 2006 to 8.85% in 2012, then slightly decreased to 8.2% in 2017.It is well-documented that households with more elderly members are significantly more likely to face CHE and impoverishing out-of-pocket health payments compared to younger households, with the poorest segments of the population being most affected. It is estimated that CHE among the elderly (at the 10% threshold) was 16.3%, which is twice the national average (8.85%). At the 10% threshold, the odds ratio depicts that the likelihood of CHE was 1.98-fold higher among households whose head is a retiree and 1.52-fold higher among households with at least one member at least 60 years old [30].

Enhancing the achievement of UHC will require effective targeting benefit packages and financial protections to address the health needs of the poorest segments of the elderly population. In the same vein, it will be judicious to invest in a life course approach to health promotion and disease prevention to slow the rise in chronic diseases and neurological and musculoskeletal conditions. Hoang-Vu Eozenou et al. [31] estimate that covering 80% of the population with an essential package that includes NCD interventions and is adequate to achieve UHC for the elderly will necessitate increasing health spending between 6% and 10% of gross national income in middle- and high-income countries. This goal requires a strong national commitment to prioritize shared health expenditures.

Mauritius has made noteworthy progress in its UHC Service Coverage Index (SCI) over the past decades, achieving an average score of 66 in 2021, which is just two percentage points below the global average. With availability of free healthcare, the UHC SCI could have been higher if not for low scores in infectious diseases (53%) and NCDs (52%). With rising healthcare costs and national health budgets under strain from competing demands, the financial impact of an ageing population presents a major challenge to further improving the UHC SCI [32]. To mitigate the risk of an ageing population on reversing progress in terms of UHC SCI, there is need to achieve equitable and pro-poor distribution and financing of health services, while ensuring greater technical efficiency at public hospital to create fiscal space and addressing the social determinants of health. In fact, social determinants of health account for at least of 30% to 55% health outcomes globally.

The contribution of social determinants surpasses that of the health sector alone. Improving health outcomes, therefore, demands acting on the social determinants. Population ageing, along with employment, socio economic status, are one of the core determinants of health too critical to be overlooked . Achieving UHC will require effectively targeting benefit packages and financial protections to address the health needs of the poorest elderly populations. Additionally, investing in a life course approach to health promotion and disease prevention is crucial to slow the increase in chronic diseases and neurological and musculoskeletal conditions that disproportionately affect the elderly [33,34].

The implications of an increasing life expectancy are significant. McKinsey health institute [35] estimates that almost half of additional year added to life expectancy has resulted in moderate or poor health. In this regard, the WHO is promoting an approach for integrated care for older people (ICOPE), built on the premise that healthy ageing cannot be ensured without integrating health and social services within long-term care systems. The WHO ICOPE approach, which offers integrated and coordinated care from preventive to palliative services, tailored to the older person’s intrinsic capacity and functional ability, including long-term care services, is well-suited for Mauritius. In Mauritius, 24.5% of people aged 60 and older reported having difficulties performing daily activities due to health issues (19.9% of men and 28.2% of women in 2018/19.This is in contrast to 7.2% of individuals aged 40 to 59 (6.4% of men and 7.9% of women) [36].

Notwithstanding a plethora of health services are available and accessible, inherent significant gaps in patient data result in duplication of services, as well as unnecessary hospitalisation. Thus, promoting an integrated care and a person-centred approach that will enhance the health system performance is of essence. Encouraging to note the development of a national strategic and action plan for ICOPE in Mauritius. The plan provides care pathways to support screening, prevent or delay declines in intrinsic capacity, such as loss of mobility, malnutrition, visual impairment, hearing loss, cognitive decline, depressive symptoms, and functional ability. This approach will certainly help integrate elderly health needs into primary health care (PHC), using a personcentered and holistic method. By following the WHO ICOPE guidelines, health services can be optimized to better address the needs of the elderly, enhancing both their intrinsic capacity and functional ability [37,38]. Adding healthy life to years is realisable in Mauritius, provided adequate funding of this plan is secured for early detection and prevention of decline in intrinsic capacity, and developing comprehensive person-centred care plans, including enhanced case management, monitoring and follow-up of patients.

As the national ICOPE strategic plan is implemented, a key factor for success will be strengthening PHC, particularly in coordinating and integrating proactive preventive care and interventions for managing age-related chronic illnesses. Improving coordination between PHC and hospitals can help reduce inpatient and specialist care costs, ultimately enhancing the overall health systems efficiency and performance [39-41].

At the core of the reforms proposed under the Mauritius health sector strategic plan for 2020-2024 are the introduction of a family doctor service scheme and digitalisation. The family doctor service scheme, yet to be implemented, is envisaged to adopt a peoplecentred approach across the life course [42]. This approach is a window of opportunity to ensure integrated health services to the elderly. The family doctor scheme cannot be restricted to doctors. Rather, it will require a multidisciplinary team approach, including enlistment of specialists such as nutritionists, psychologists, physiotherapists, physical educators, inter alia. As these would entail additional expenditure, it will be remiss to ignore that the latter costs will be offset by benefits in terms of healthy ageing gains whereby chronic diseases are controlled and managed holistically. The responsibility of providing free domiciliary medical visits to bedridden persons aged 75 years and above as well as all persons aged 90 years and above, irrespective the degree of infirmity, is vested in another ministry other than health. These services are however rather often reactive, and not always adequately adapted to the management of older patients with serious comorbidity. The introduction of the family doctor service scheme would help addressing these gaps. Similarly, digitalization is essential for managing chronic illness treatments and deploying appropriate care by multidisciplinary teams. By effectively organizing patient information, implementing an eHealth program will enable health systems to identify the needs of older adults, plan necessary care promptly, and monitor treatment responses [43].

Decisions to raise the retirement age will boost labour market participation but on the other hand, an unhealthy ageing population can negatively affect labour productivity and slow economic growth. Since economic growth enhances consumption and thereby increases tax revenue, economic slowdowns will reduce the effectiveness of income and consumption taxes in funding the national health system, which relies heavily on taxation.

As the demand for geriatric care is expected to grow , there will be need to enlist and contract out the services of private health care providers. In this respect, to promote efficiency gains, equity in accessing services and distribution of resources, institutionalisation of strategic purchasing policy is recommended. Strategic purchasing framework will allow linking and allocation of pooled funds to healthcare providers for the delivery of geriatric health services, with information on aspects of performance and/or on the health needs of the population that they serve.

Limitation

A caveat of the PASH Simulator is the assumption of status quo in the level of labour productivity. On the other hand, improvement in labour, which impacts GDP, is expected to increase the tax base, and contribute to health care financing. The labour productivity index in Mauritius witnessed an increase from 105.2 in 2009 to 134.6 in 2019, representing an average annual growth of 2.5% [44]. From this perspective, the health care financing gap is somewhat overestimated.

Conclusion

The PASH model demonstrates that addressing age-related care on a national level will have significant and growing financial costs over time. This challenge may due to the fact that poor health conditions among the elderly disproportionately impact the poor and vulnerable. The solution would be to invest in healthy ageing programmes to help more older adults stay in the workforce longer and reduce the demand for healthcare. This, in turn, will lessen the negative effects of an aging population on healthcare costs and economic growth.

Given that welfare state principles are deeply embedded in national policy frameworks—and backed by strong political will to uphold and expand social protection—the future financing of healthcare services will exert increasing pressure on government revenues. Without bold reforms in health financing, including progressive taxation and strategic resource allocation, the sustainability of health systems will be at risk. It is critical that health sector financing strategies be revised to ensure sustainable and sufficient financial resources, while also promoting efficiency and fairness in resource use. Such strategies are essential not only to protect populations from catastrophic health expenditures, but also to support improvements in the UHC SCI.

Abbreviations

CHE: Catastrophic health expenditure, GDP: Gross domestic product, GGHE: General government health expenditure, ICOPE: Integrated care for older people, NCD: Noncommunicable diseases, OOP: Out of pocket payments, PASH: Population Ageing Financial Sustainability gap for Health systems, PHC: Primary health care,

UHC: Universal health coverage, SCI: service coverage index, WHO: World Health Organization

Acknowledgements

The views expressed in this paper are solely those of the authors and do not in any way represent the views of the institution they are employed with. The authors acknowledge the European Observatory on Health Systems and Polices for making the Population Ageing financial Sustainability gap for Health systems (PASH) Simulator accessible online.

Ethics Declaration

Ethics Approval and Consent to Participate

Not applicable as no human participation is involved.

Patient and Public Involvement

No patient or public was involved in this research

Consent for Publication

Not applicable

Availability of Data and Supporting Materials Section

Data is accessible from the Population Ageing financial Sustainability gap for Health systems (PASH) Simulator, developed by European Observatory on Health Systems and Polices.

Competing Interests

The author declares no competing interests.

Funding

This paper did not require any funding to be realised.

References

- Mason CN, Miller T (2018) International projections of age specific healthcare consumption: 2015-2060. J. Econ Ageing 12: 202-217.

- Lee RD (2014) Macroeconomic consequences of population aging in the United States: Overview of a national academy report. Amer Econ Rev 104: 234-239.

- Bakx P, O’Donnell O, Van Doorslaer E (2016) Spending on health care in the Netherlands: not going so Dutch. Fisc Stud 593–625.

- Lee R, Miller T (2002) An approach to forecasting health expenditures, with application to the US Medicare system. Health Serv Res 37: 1365-1386.

- Di Matteo L (2010) The sustainability of public health expenditures: evidence from the Canadian federation Eur J Health Econ 11: 569-584.

- Thomson S, Foubister T, Figueras J, Kutzin J, Permanand G, et al. (2009) Addressing financial sustainability in health systems. European Observatory on Health Systems and Policies.

- United Nations General Assembly. 74th session Political declaration of the high-level meeting on universal health coverage.

- Williams G, Cylus J, Roubal T, Ong P, Barber S (2019) Sustainable health financing with an ageing population: will population ageing lead to uncontrolled health expenditure growth? World Health Organization. Copenhagen.

- Peterson P Foundation (2024) How Does the Aging of the Population Affect Our Fiscal Health?

- de Biase P, Dougherty S, and Lorenzoni L (2022) “Ageing and the long-run fiscal sustainability of health care across levels of government”, OECD Working Papers on Fiscal Federalism. No. 38, OECD Publishing. Paris.

- WHO (2025) How does population ageing affect health system financial sustainability and affordable access to health care in Europe? Copenhagen: WHO Regional Office for Europe.

- Cylus J, Williams G, Carrino L, Roubal T, Barber S (2022) Population ageing and health financing: A method for forecasting two sides of the same coin. Health Policy. 126: 1226-1232.

- European Commission (2018) The 2018 Ageing Report. Economic & Budgetary Projections for the 28 EU Member States (2016-2070). Publications Office of the European Union., Luxembourg.

- Yashio H, Hachisuka K (2014) Impact of population aging on the personal income tax base in Japan: simulation analysis of taxation on pension benefits using microdata. Public Policy Rev 10: 519-542.

- Howdon D, Rice N (2018) Health care expenditures, age, proximity to death and morbidity: Implications for an ageing population. J Health Econ 57: 60-74.

- Nozaki M, Kashiwase K, Saito I (2017) Health spending in Japan: macro-fiscal implications and reform options. J Econ Ageing 9:156-171.

- Cylus J, Tayara LA (2021) Health, an ageing labour force, and the economy: does health moderate the relationship between population age-structure and economic growth? Soc Sci Med 287: 114353.

- van den Berg T, Schuring M, Avendano M, Mackenbach J, Burdorf A The impact of ill health on exit from paid employment in Europe among older workers. Occup Environ Med 67: 12.

- Soto M, Thakoor VV, Petri M (2015) Pension Reforms in Mauritius: Fair and Fast-Balancing Social Protection and Fiscal Sustainability. IMF Working Paper.

- Ministry of Health & Wellness (2022) Republic of Mauritius. Health Statistics Report

- Ministry of Health & Wellness (2020) Republic of Mauritius. National Health Accounts.

- WHO. Global Health Expenditure Data base (GHED).

- Statistics Mauritius. Housing and Population Census.

- SIDS & UN DESA (2024) Partners for a prosperous, sustainable and resilient future for small island developing States. 4th International Conference on Small Island Developing States.

- Health and climate change: country profile (2021) Mauritius. World Health Organization.

- Kenny, GP, Yardley J, Brown C, Sigal RJ, Jay O (2010) “Heat stress in older individuals and patients with common chronic diseases.” CMAJ : Canadian Medical Association journal=journal de l’Association medicale canadienne. 182: 1053-1060.

- United Nations Department of Economic and Social Affairs Population Division (2022) World Population Prospects.

- European Observatory on Health Systems and Policies (2022) Population Ageing financial Sustainability gap for Health systems (PASH) Simulator.

- Cylus J, Normand C, Williams G (2022) The implications of population ageing for health financing in the Western pacific region : exploring future scenarios and policy options for selected countries using the pash simulator. European Observatory on Health Systems and Policies.

- Nundoochan A, Thorabally Y, Monohur S, Hsu J (2019) Impact of out of pocket payments on financial risk protection indicators in a setting with no user fees: the case of Mauritius. Int J Equity Health 18: 63.

- Hoang-Vu Eozenou P, Neelsen S, Smitz MF (2021) Financial Protection in Health among the Elderly – A Global Stocktake, Health Systems & Reform. 7: e1911067.

- WHO Global Health Observatory data repository. Index of service coverage Data by country.

- Nundoochan A (2021) Improving equity in the distribution and financing of health services in Mauritius, a small island state with deeply rooted welfare state standards. BMJ Global Health. 6: e006757.

- World Health Organisation (2021) Social Determinants of Health.

- McKinsey Health Institute. The secret to great health? Escaping the healthcare matrix.

- Statistics Mauritius (2020) How do Mauritians feel about their health.

- Integrated care for older people (ICOPE) (2024) Guidance for person-centred assessment and pathways in primary care, 2nd Edition. World Health Organization.

- World Health Organization (2019) Integrated care for older people (ICOPE) implementation framework: guidance for systems and services. World Health Organization.

- Kruk ME, Porignon D, Rockers PC, Lerberghe WV (2010) The contribution of primary care to health and health systems in low- and middle-income countries: a critical review of major primary care initiatives. Soc Sci Med 70: 904-911.

- Haque M, Islam T, Rahman NAA, McKimm J, Abdullah A, et al. (2020) Strengthening primary Health-Care services to help prevent and control long-term (chronic) non-communicable diseases in low- and middle-income countries. Risk Manag Health Policy 13: 409-426.

- Hou X, Liu L, Cain J (2022) Can higher spending on primary healthcare mitigate the impact of ageing and noncommunicable diseases on health expenditure? BMJ Global Health. 7: e010513.

- Ministry of Health & Wellness (2020) Republic of Mauritius. Health Sector Strategic Plan (2020-2024).

- World Health Organization (2015) World report on ageing and health.Geneva, Switzerland.

- Central Statistical Office, Republic of Mauritius Productivity and Competitiveness Indicators (2009-2019)

© by the Authors & Gavin Publishers. This is an Open Access Journal Article Published Under Attribution-Share Alike CC BY-SA: Creative Commons Attribution-Share Alike 4.0 International License. Read More About Open Access Policy.